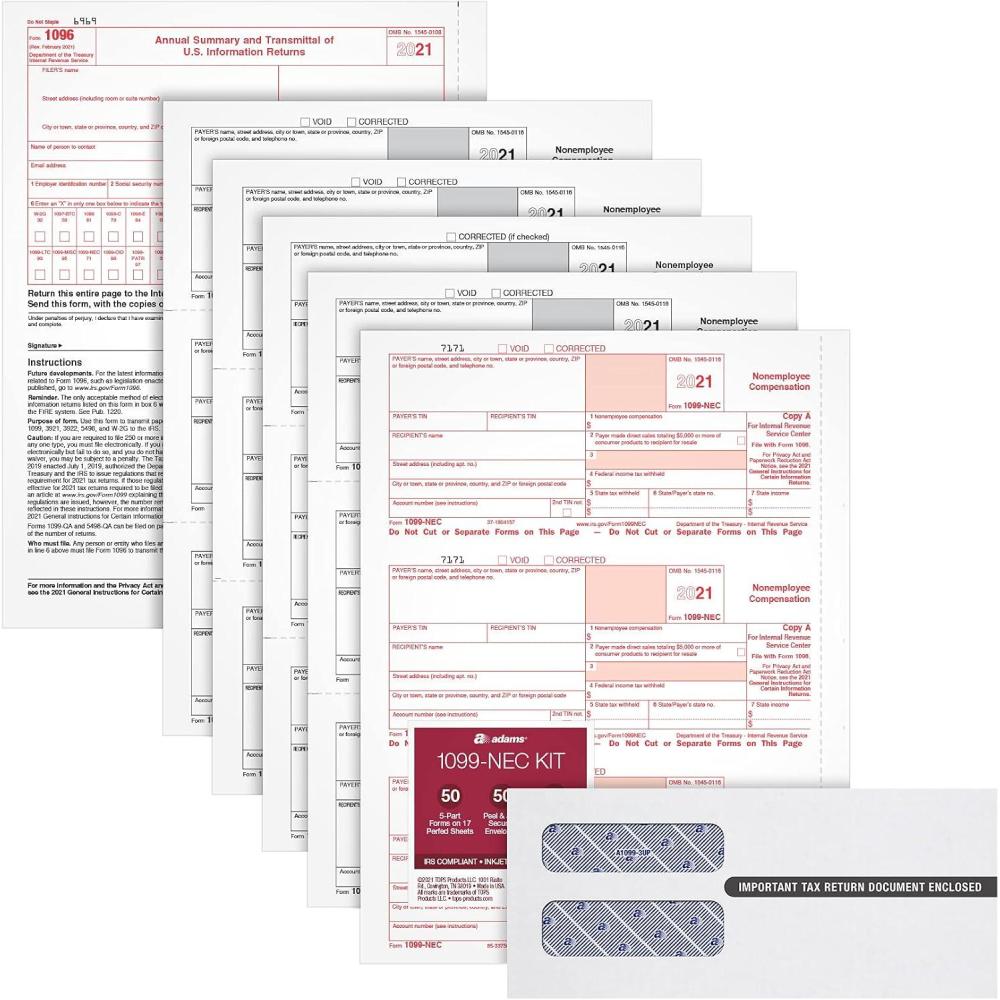

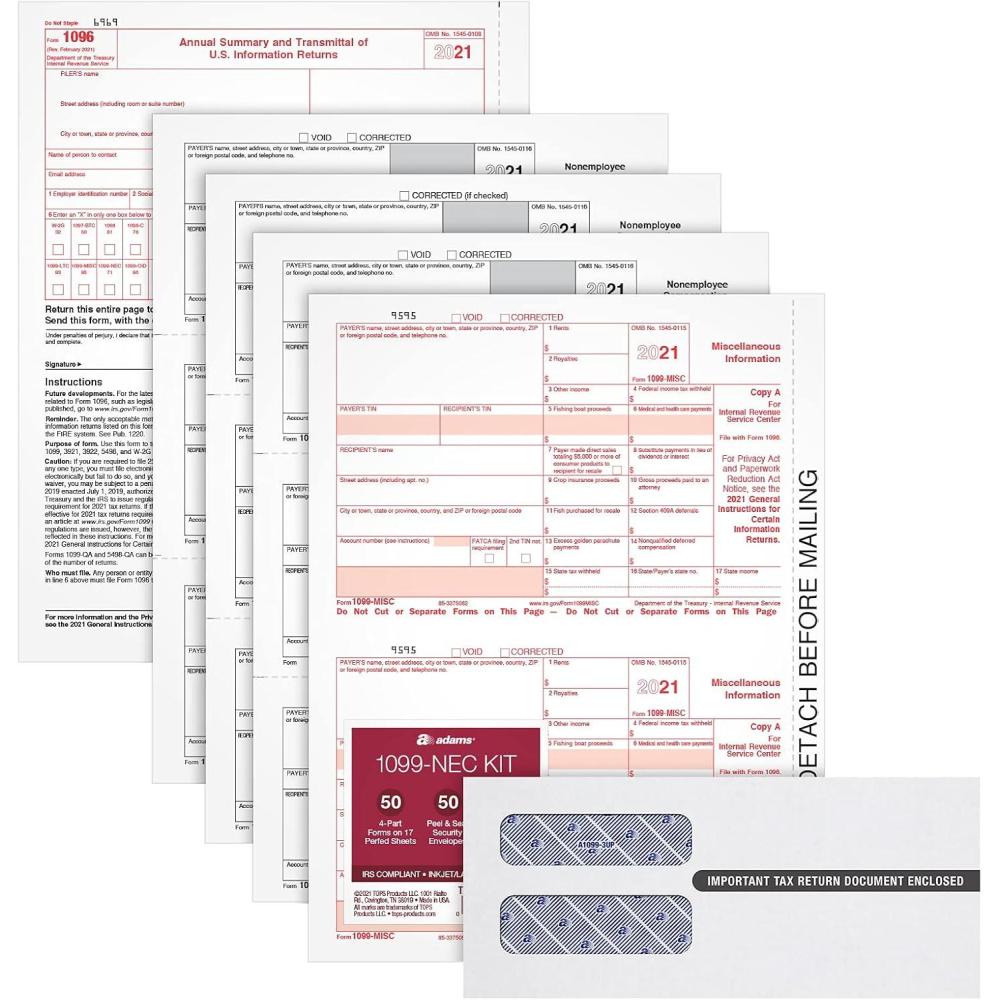

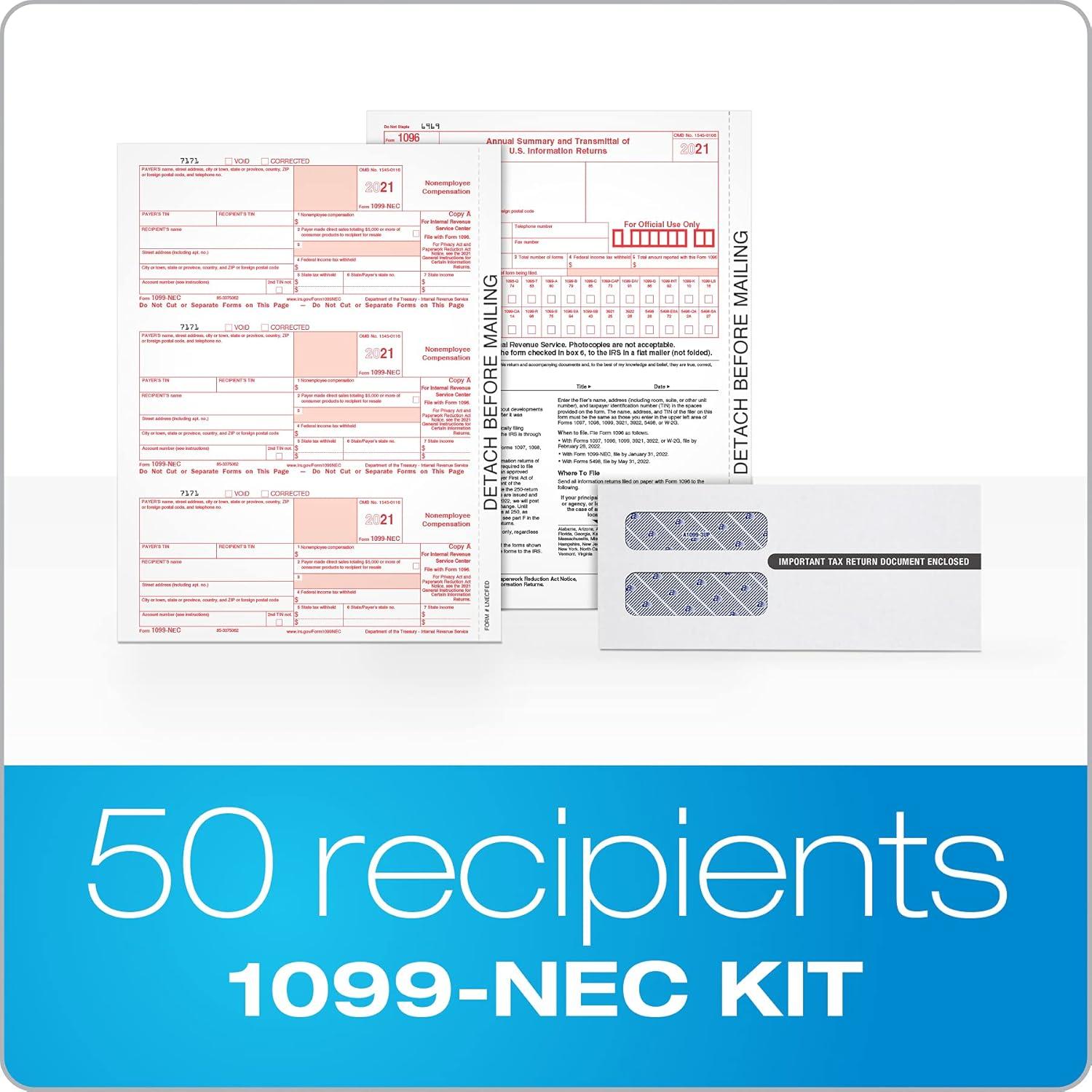

Adams 1099 NEC 3 Up Forms 2021, 4 Part Laser/Inkjet 1099 Forms with Self Seal Envelopes, for 50 Recipients, Includes 3 1096 Forms (TXA225504-NEC21)

Original price was: $99.99.$59.99Current price is: $59.99.

Shop now and get free shipping on your purchase of products.

Description

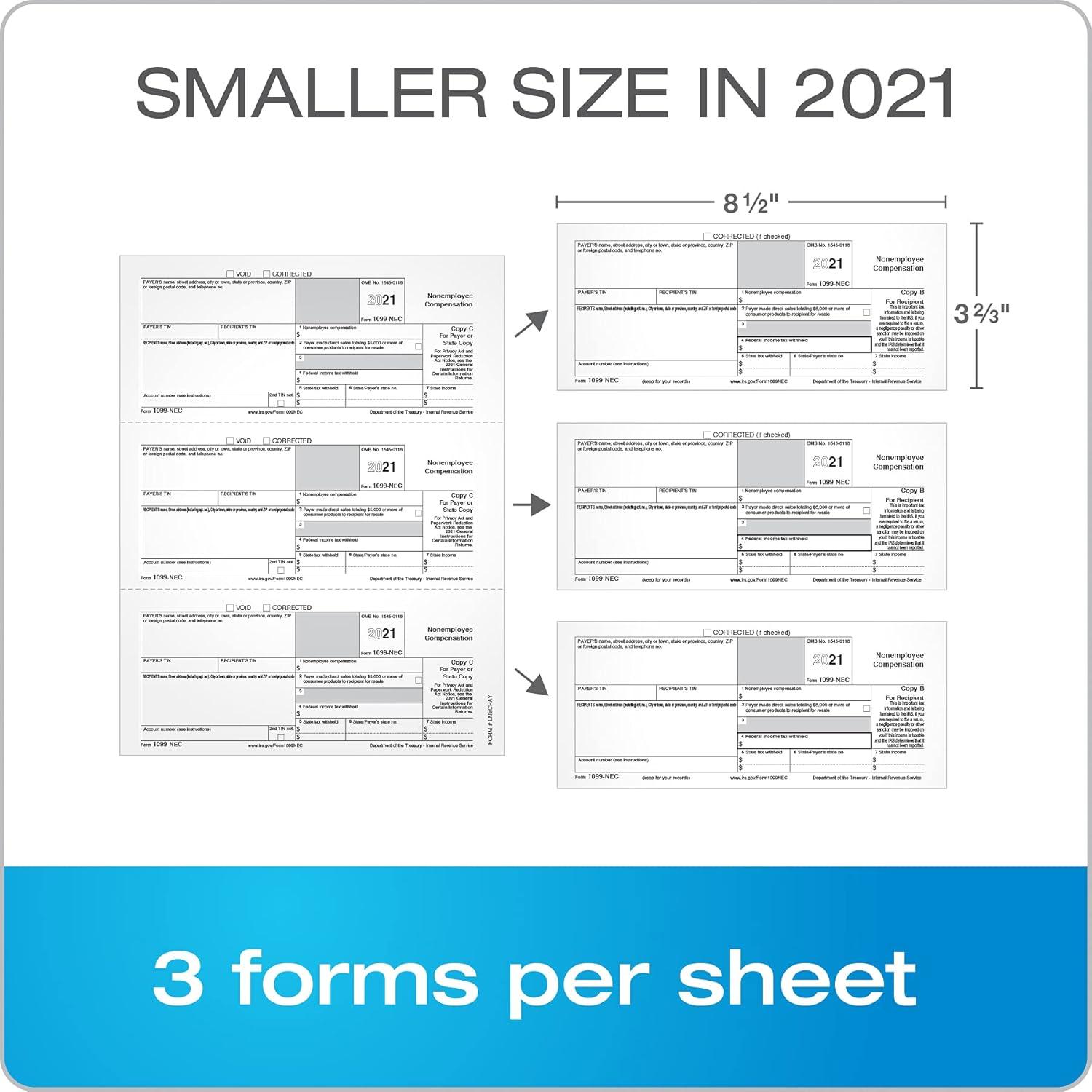

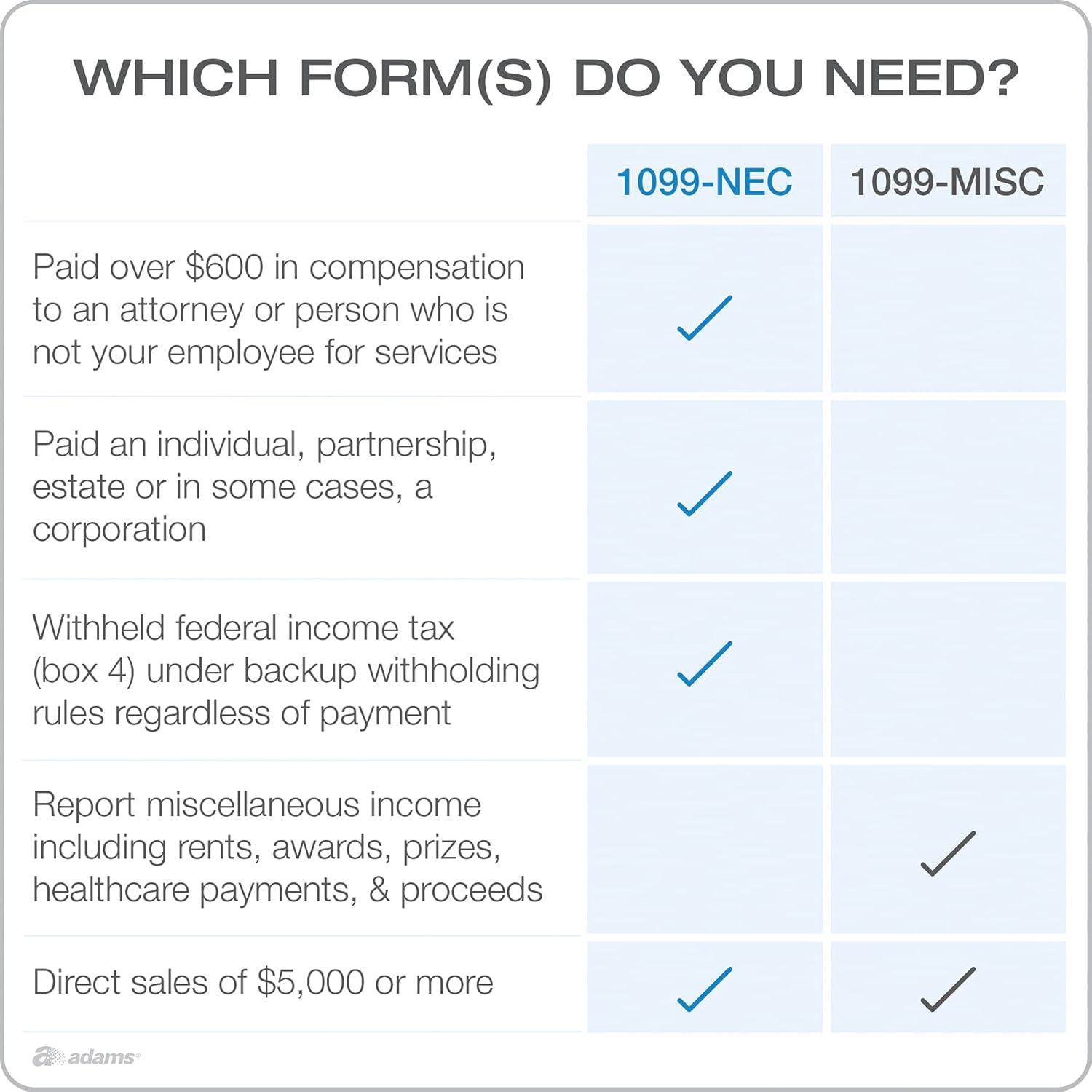

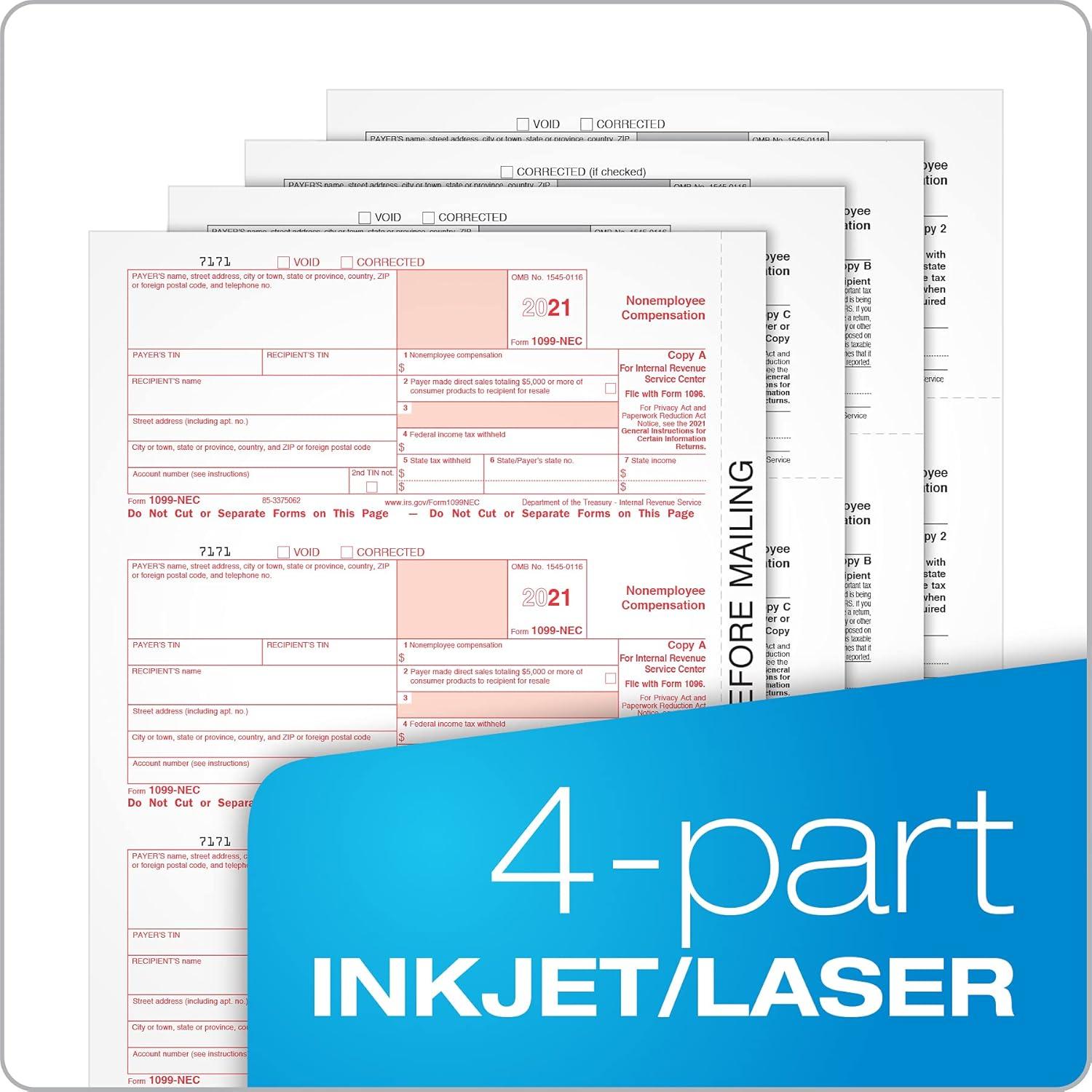

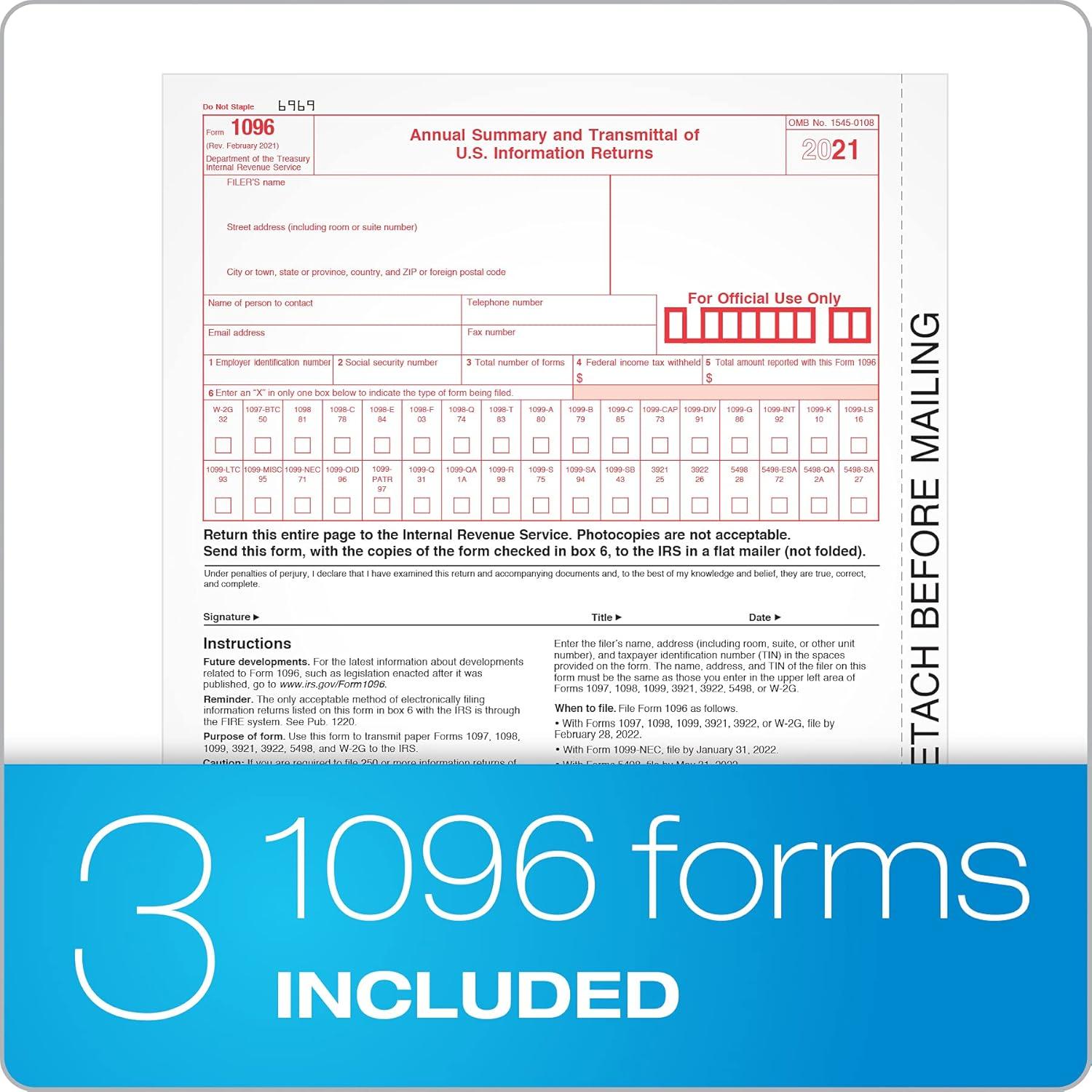

This Adams 1099 NEC Tax Forms Kit provides the forms and envelopes you need to report nonemployee compensation for up to 50 recipients. Includes 50 4-Part 1099 NEC forms, 50 time-saving peel and seal security envelopes and 3 1096 summary forms. The 1099 NEC returns in a smaller, 3-up format for 2021. You must mail or eFile your 1099 NEC to the IRS and furnish copies to your recipients by January 31, 2022. What counts as nonemployee compensation and who needs to file? You’ll need to file the NEC if all of the following are true: you paid more than $600 in compensation to a contractor (someone who is not your employee) for services; you paid a person, a partnership, an estate, or, in some cases a corporation; and you withheld federal income tax (box 4) under backup withholding rules in any amount. Look for 2 NEC updates in 2021. You can now report payer-made sales of $5,000 or more in 1099-NEC box 2 OR 1099-MISC box 7, so fewer filers will need both forms. Also, you can no longer report cash paid for fish for resale in 1099-NEC box 1; you’ll use 1099-MISC box 11 instead. See IRS instructions for complete details. Adams 2021 1099 NEC tax forms are inkjet and laser printer compatible. Forms meet IRS specifications. Acid free paper and heat-resistant inks produce smudge-free, archival safe records. Comes with new smaller 3-up 1099-NEC tax envelopes to fit 3 up forms. Our 1099 envelopes have a security tint, strong peel & seal adhesive and double windows. Precise window placement keeps personally identifiable information secure. For QuickBooks and other accounting software. Also compatible with Adams Tax Forms Helper Online, the fast and easy way to file without discs, downloads or updates. Software not included. 50 Pack.

Reviews

There are no reviews yet.